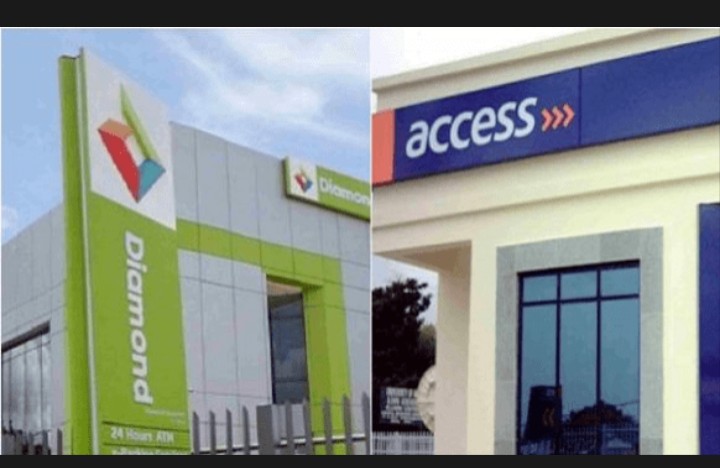

Access Bank and Diamond Bank’s merger plan is no longer news as both Nigerian lenders formalise the process by the end of the first quarter of 2019.

As the formalisation process continues to take a centre stage and both financial institutions hope to get shareholders’ approval next month, stakeholders and customers with accounts in both banks look forward to considerable answers on their accounts.

This and many other questions were answered by Herbert Wigwe and Uzoma Dozie, the Chief Executive Officers (CEOs) of Access Bank Plc and Diamond Bank Plc at an interactive session on Wednesday, January 16, 2018, held at Access Bank HQ, Lagos.

On the issue of double account numbers for customers after the completion of the Access-Diamond Bank merger process, Herbert Wigwe, CEO of Access Bank, said the bank will allow customers to maintain whatever account they decided to run.

“Either the Diamond Bank or Access Bank account, every customer will allow to decide on which to run and continue,” he said without giving many details.

Wigwe said the two banks’ mobile application platforms will be upgraded to create a strong and formidable mobile app that will be accessible and make instantaneous settlement across Africa.

“What are we doing to blend financial institutions with lifestyle products to create Africa’s biggest retail institution,” Uzoma Dozie added.

The Access Bank CEO further states that some brand and products of Diamond Bank will be retained despite swallowing the name.

“Some identities will stay, Diamond Bank Xtra as a product will continue after the merger process,” the CEO says.