The Nigerian oil industry is often described as a river of gold, turbulent, full of twists, and capable of swallowing even the wealthiest with a single misstep. In early 2026, a quiet storm formed in the heart of this river, a transaction that had all the markers of history in the making. A French energy giant, TotalEnergies, decided to divest a 10% non-operated stake in a major Nigerian oil venture, a stake that could have reshaped the fortunes of those already perched atop the country’s economic ladder. By the time the dust settled, a consortium most had never heard of emerged victorious, leaving Nigeria’s billionaires on the riverbank watching an opportunity slip into hands nimble, strategic, and prepared in ways the old guard had underestimated.

The venture in question is tied to what was once the sprawling interests of the Shell Petroleum Development Company, now organized under the Renaissance Joint Venture. It holds eighteen oil and gas licenses across the Niger Delta, an area both rich in crude and steeped in operational risk.

This ten percent stake contributes sixteen thousand barrels of oil equivalent per day, a volume sufficient to draw interest from anyone serious about Nigeria’s upstream sector. The sale also carries economic interest in gas production feeding Nigeria LNG, a detail that makes it more than a simple oil stake, positioning it as a strategic foothold in both energy streams.

The episode illuminated a broader truth about Nigeria’s oil sector: deep pockets do not guarantee entry. The river moves swiftly, and in a market where regulatory approvals, environmental compliance, and operational readiness are as critical as capital, even the wealthiest can find themselves waiting on the bank while others navigate the currents with quiet efficiency.

The Anatomy of the Sale

TotalEnergies’ decision to divest this ten percent stake is part of a global strategy to shift away from older, onshore, higher-risk assets toward offshore exploration and gas production. For Nigeria, this represents both a challenge and an opportunity. The sale is not simply about transferring ownership; it is about navigating the complex web of federal approvals, local content regulations, and corporate strategy that governs every upstream transaction. The Renaissance Joint Venture’s eighteen licenses span areas with varying production profiles, environmental challenges, and social dynamics. A buyer must do more than provide capital; they must demonstrate operational capacity, regulatory compliance, and strategic vision.

The stake itself, producing sixteen thousand barrels of oil equivalent per day, represents a meaningful position in Nigeria’s energy landscape. Production is spread across multiple fields with different operating characteristics, and operational control rests with larger partners. Ownership here is not passive. A shareholder must engage in technical decisions, approvals for capital expenditure, and strategic planning that can affect the output and profitability of the venture. This adds layers of complexity for any potential buyer and raises the stakes for those hoping to enter the market.

The broader context of TotalEnergies’ divestment also matters. Nigeria’s upstream sector is at a crossroads, with international majors divesting older onshore assets due to security, environmental, and economic pressures. Local and African players are gradually assuming control over legacy oil interests. This shift underscores a new era in which wealth alone does not dictate success. Regulatory demands, capital requirements, and operational readiness have emerged as decisive factors in determining who wins and who is left on the sidelines.

Who Won the Bid and How

Vaaris Resources JV Company Limited emerged from relative obscurity to claim what many assumed would fall into the hands of Nigeria’s wealthiest. Formed in late 2025, the consortium was nimble, strategic, and precise, combining local operators with specialized oilfield services firms. Unlike the billionaire-led groups, Vaaris had no history of sprawling corporate bureaucracy. Its strength lay in cohesion and readiness, a unity that allowed it to move faster through TotalEnergies’ requirements and regulatory checkpoints. In a market where delays can erode opportunities, this agility proved decisive.

Reports indicate the deal was valued at approximately eight hundred million dollars, though neither TotalEnergies nor Vaaris has officially confirmed the figure. The amount reflects not just the immediate value of oil production but also strategic access to gas licenses feeding Nigeria LNG. Analysts note that the stake’s real worth extends beyond barrels per day. Control over even a ten percent share allows influence over operational decisions, approvals for capital expenditure, and participation in Nigeria’s complex upstream governance framework. For Vaaris, acquiring this stake was both a financial investment and a strategic foothold.

Vaaris’ approach to the transaction was methodical. The consortium maintained continuous engagement with TotalEnergies and regulators, demonstrating compliance with local content requirements and readiness to meet operational obligations. While billionaire-led consortiums focused on the scale of their capital, Vaaris showcased speed and precision. It presented not just financial capacity but operational clarity, a roadmap for managing the asset effectively, and readiness to address both technical and social obligations in the Niger Delta, where community relations can make or break production.

The result was a perfect convergence of timing, regulatory alignment, and strategic positioning. Vaaris stepped into a space where others hesitated or stalled, and in doing so secured a rare victory in Nigeria’s competitive oil market. Its success underscores a shift in the rules of engagement: financial muscle alone no longer guarantees access to strategic assets. In an environment where approvals, operational capability, and local engagement matter as much as capital, the winners are often those who can navigate complexity with precision.

Why Billionaires Were Locked Out

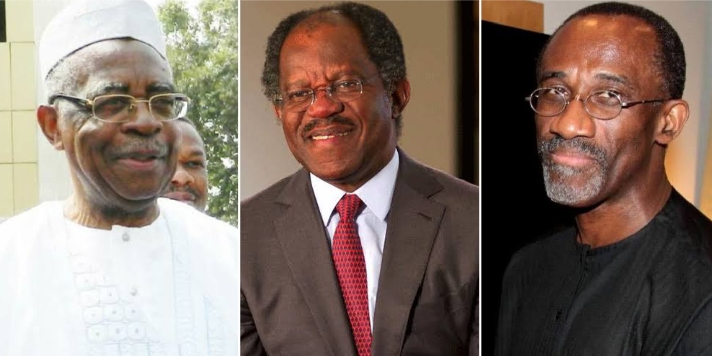

The Nigerian billionaires who pursued this stake were caught off guard by the dynamics of the auction and the conditions imposed by regulators. Names like Gen. Theophilus Danjuma’s South Atlantic Petroleum and billionaire investors such as Bayo Ogunlesi and Hakeem Belo-Osagie had been widely expected to lead the acquisition. These groups had history, influence, and financial depth, yet they ultimately failed to close. The reasons lie in the convergence of regulatory complexity, financing readiness, and strategic nimbleness, factors that proved more critical than sheer wealth.

Earlier attempts to acquire the same stake illustrate the fragility of high-profile deals. In 2024 and 2025, TotalEnergies sought to sell the stake to Chappal Energies for approximately eight hundred sixty million dollars. Regulators initially approved the sale, but the deal unraveled when the buyer could not meet financial obligations and satisfy compliance conditions. This episode set the stage for the 2026 sale, demonstrating that timing, preparation, and adherence to regulatory criteria are decisive in Nigerian upstream transactions.

During the 2025-2026 process, billionaire-led consortiums engaged with TotalEnergies and government officials to secure approvals and line up funding. Despite appearances of front-runner status, delays in financing arrangements and the procedural hurdles required for operational readiness slowed their progress. Each day that passed allowed Vaaris to demonstrate consistency and preparedness, a crucial advantage in a market where windows of opportunity close as quickly as they open.

The Broader Oil Sector Context

This divestment is more than an isolated transaction; it reflects a fundamental transformation in Nigeria’s upstream oil landscape. International majors, including TotalEnergies and Shell, are gradually divesting older, onshore, higher-risk assets due to a combination of security, environmental, and economic pressures. The shift creates openings for local and African players to consolidate control over legacy resources, fundamentally altering the ownership map of Nigerian oil. What was once a sector dominated by a handful of global companies is becoming more locally controlled.

Local content requirements, regulatory approval timelines, and operational standards now play an outsized role in determining winners. Billionaires with capital must meet stringent criteria that go beyond money. Proof of operational capability, local partnerships, and readiness to manage social obligations in producing communities is increasingly central. The TotalEnergies stake sale illustrates how these factors converge to shape market outcomes. Entities that can demonstrate compliance and operational clarity gain leverage, even against deep-pocketed competitors.

The rise of consortiums like Vaaris signals a broader democratization of opportunity. Where previously influence and capital alone dictated outcomes, the new rules reward strategic organization and speed. This reflects both Nigerian government policy and the strategic priorities of international oil companies, which increasingly favor buyers capable of managing operational, social, and regulatory complexity. The sale serves as a case study in how local players can compete effectively in a landscape once dominated by billionaires and global majors.

Implications for Nigerian Oil and Gas

The implications of this transaction extend beyond the immediate winners and losers. Ownership shifts influence operational decisions, capital investment patterns, and local economic dynamics. With Vaaris now positioned to influence a significant upstream asset, other players in the sector will observe closely, particularly how the consortium manages production, community relations, and compliance with regulatory frameworks. These outcomes will set precedents for future divestments and acquisitions.

The sale also has potential ripple effects on financing and partnerships. International banks and investors may recalibrate their assessment of Nigerian oil, prioritizing buyers that can demonstrate operational readiness alongside capital. Local and regional players will see opportunities to leverage consortium models to acquire stakes that might previously have seemed out of reach. In this sense, Vaaris’ success could inspire a new generation of structured, technically competent entrants to the market.

For the billionaires who were locked out, the transaction may prompt strategic reassessment. Consolidating influence in Nigerian oil is no longer simply a function of wealth or access to policymakers. Timing, preparation, and consortium structure matter as much, if not more. Future bids will likely emphasize operational readiness, regulatory engagement, and coalition-building, reflecting lessons learned from the TotalEnergies sale.