Have you ever wondered about the origins of the naira notes in your wallet? As you handle Nigeria’s colorful paper currency, you may not realize its relatively recent history.

The introduction of paper money marked a significant milestone in Nigeria’s economic development, yet many are unaware of when this transition occurred.

Understanding the timeline of Nigeria’s currency evolution provides valuable insight into the country’s journey from colonial rule to independence and beyond. Join us as we explore the fascinating story behind when paper currency was first introduced in Africa’s most populous nation and how it has shaped Nigeria’s financial landscape.

The History of Currency in Nigeria

Before the arrival of European colonizers, Nigerians used various forms of currency. Cowrie shells were widely accepted, especially in the southern regions. Other commodities like salt, cloth, and metal objects also served as mediums of exchange.

The British colonial era brought significant changes to Nigeria’s monetary system. In 1912, the West African Currency Board introduced the British West African pound. This currency was used not only in Nigeria but also in other British colonies in West Africa.

When Nigeria gained independence in 1960, it continued to use the West African pound for a short period. However, in 1973, the country took a significant step towards monetary sovereignty by introducing its own currency: the Nigerian pound.

The pivotal moment in Nigeria’s currency history came on January 1, 1973. The Nigerian government replaced the pound with the naira, marking a new era in the country’s financial system.

Since its introduction, the naira has undergone several redesigns and denominations to meet the changing economic needs of the nation. Today, it remains the official currency of Nigeria, a testament to the country’s rich monetary history and economic independence.

When was Paper Currency Introduced in Nigeria?

Let’s explore how Nigeria transitioned from traditional forms of exchange to the paper notes we use today.

Before paper money, Nigerians used various forms of currency, including cowrie shells and metal coins. These served as the primary means of trade for centuries. However, as the economy grew more complex, a more versatile form of money became necessary.

The British colonial administration played a crucial role in shaping Nigeria’s monetary system. In the early 20th century, they introduced the West African pound, which was used in several British West African colonies. This marked a significant step towards a unified currency system.

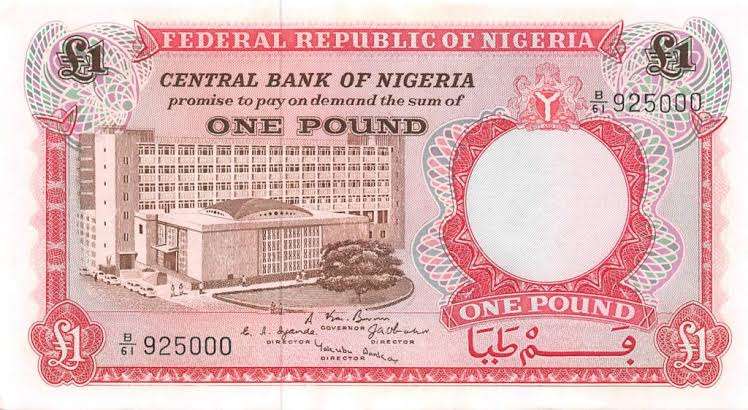

The pivotal moment came on July 1st, 1959, just before Nigeria gained independence. This year marked when paper currency was introduced in Nigeria officially. The Central Bank of Nigeria, established in 1958, issued the country’s first paper notes. These new banknotes, denominated in Nigerian pounds, shillings, and pence, replaced the West African pound.

The new Nigerian pound notes were more than just pieces of paper, they symbolized Nigeria’s emerging identity as a sovereign nation. These first banknotes featured imagery that celebrated Nigerian culture and heritage, helping to foster a sense of national pride among citizens. The introduction of paper currency symbolized more than just a change in money form. It represented Nigeria’s growing economic autonomy and readiness for independence.

Since its introduction, Nigerian paper currency has undergone several changes. In 1973, Nigeria switched from the pound to the naira, which remains the country’s official currency today. Over the years, you’ve probably noticed various redesigns and denominations introduced to meet the changing economic needs of the country.

As you handle Nigerian naira today, remember that you’re holding a piece of history, a tangible reminder of the nation’s journey towards financial sovereignty.

Key Milestones in the Introduction of Paper Currency

Let’s explore the journey of Nigeria’s monetary system from cowrie shells to modern banknotes.

Colonial Era Currency

Your grandparents might remember a time when cowrie shells were used as money in Nigeria. But as British influence grew, things changed. In 1912, the West African Currency Board (WACB) was established, marking a significant shift. They introduced the West African pound, shillings, and pence – the first standardized currency for the region.

Birth of the Nigerian Pound

Fast forward to 1959, just before Nigeria gained independence. The Central Bank of Nigeria (CBN) was established, paving the way for a truly Nigerian currency. On July 1, 1959, the Nigerian pound was born, replacing the West African pound. This was a huge step towards monetary sovereignty for the soon-to-be independent nation.

Enter the Naira and Kobo

The real game-changer came in 1973. On January 1st, Nigeria bid farewell to the pound and welcomed the naira and kobo. This decimal currency system, with 100 kobo making up one naira, is still in use today. When was paper currency introduced in Nigeria in its current form? This 1973 transition marks the true beginning of modern Nigerian banknotes.

Continuous Evolution

Since then, the CBN has introduced various denominations and designs. From the colorful 5 naira note to the polymer 10 naira bill introduced in 2007, Nigeria’s currency continues to evolve. Each new design tells a story of Nigeria’s rich culture and history.

Remember, the introduction of paper currency in Nigeria wasn’t a single event, but a journey spanning decades. It’s a testament to the country’s growth from a colonial territory to a proud, independent nation with its own unique monetary identity.

The Role of the Central Bank of Nigeria in Paper Currency

The Central Bank of Nigeria (CBN) plays a pivotal role in the country’s monetary system, particularly when it comes to paper currency. Since its establishment in 1958, the CBN has been the sole issuer and manager of Nigeria’s paper money, ensuring that the nation’s currency remains stable and secure.

While the country had used various forms of currency throughout its history, the CBN took charge of issuing paper currency in 1959, shortly after its founding. Since then, the bank has been responsible for printing, distributing, and managing the circulation of naira notes throughout the country.

The CBN carefully monitors the money supply, adjusting it as needed to maintain economic stability. This involves not only introducing new notes but also withdrawing old or damaged ones from circulation. By controlling the amount of paper currency in the system, the CBN helps regulate inflation and maintain the naira’s value.

As technology advances, so do the security features of Nigeria’s paper currency. The CBN continually updates banknote designs to incorporate cutting-edge anti-counterfeiting measures. These innovations help protect the integrity of the naira and maintain public trust in the currency.

Moreover, the CBN has been at the forefront of modernizing Nigeria’s payment systems. While paper currency remains crucial, the bank also promotes digital alternatives to cash, balancing traditional methods with new financial technologies.

By managing paper currency and embracing innovation, the Central Bank of Nigeria ensures that the country’s monetary system remains robust and adaptable to changing economic needs.

The Design and Security Features of Nigerian Paper Currency

When paper currency was introduced in Nigeria, it wasn’t just about replacing coins with bills. The design and security features of these new notes were carefully crafted to represent the nation’s identity and protect against counterfeiting.

Symbolic Imagery

Nigerian paper currency showcases the country’s rich cultural heritage and natural resources. You’ll find iconic landmarks, traditional artwork, and portraits of notable figures adorning the bills. These images serve as a reminder of Nigeria’s diverse history and achievements.

Over time, Nigerian banknotes have incorporated increasingly sophisticated anti-counterfeiting measures:

- Watermarks: Hold a bill up to the light, and you’ll see hidden images.

- Security threads: These thin, embedded strips often have microprinting.

- Color-shifting ink: Tilt the note, and watch certain elements change color.

- Raised printing: Run your fingers over the bill to feel textured areas.

These features not only make the currency more secure but also add to its visual appeal. As technology advances, so do the security measures, making Nigerian paper currency a fascinating blend of art and science.

Remember, the introduction of paper currency in Nigeria marked a significant milestone in the country’s economic history. It’s a testament to Nigeria’s growth and modernization, reflecting the nation’s journey through its designs and security innovations.

The Impact of Paper Currency on the Nigerian Economy

This pivotal moment in the country’s financial history had far-reaching effects on its economy. Let’s explore how the shift to paper money transformed Nigeria’s financial landscape and set the stage for modern economic growth.

Modernizing the Financial System

The introduction of paper currency in Nigeria marked a significant leap towards a more sophisticated monetary system. You might not realize it, but this change made financial transactions much easier and more efficient. Gone were the days of lugging around heavy coins or relying solely on barter. Paper money allowed for smoother trade, both domestically and internationally.

Boosting Economic Growth

With the advent of paper currency, Nigeria’s economy experienced a notable boost. You could see the effects in various sectors:

- Trade became more streamlined, encouraging business expansion

- Banks could more easily manage and distribute money

- The government gained better control over monetary policy

These changes laid the groundwork for Nigeria to become the economic powerhouse it is today in West Africa.

Challenges and Opportunities

Of course, the transition wasn’t without its hurdles. When paper currency was introduced in Nigeria, it faced initial skepticism from some quarters. People had to adjust to the new system, and measures were needed to prevent counterfeiting. However, these challenges also spurred innovations in security features and financial education.

In the long run, paper currency opened up new possibilities for Nigeria’s economy. It paved the way for more complex financial instruments and helped integrate the country into the global financial system. Today, as you use naira notes in your daily life, you’re benefiting from this transformative shift that began decades ago.

Frequently Asked Questions

These are some frequently asked questions and answers about when Paper currency was introduced in Nigeria.

What currency was used before paper money?

Prior to the introduction of paper currency, Nigeria used the British West African pound. This currency was shared among several British colonies in West Africa, including Ghana, Sierra Leone, and Gambia. The West African pound was subdivided into shillings and pence, following the British monetary system.

How did the introduction of paper currency impact Nigeria’s economy?

The introduction of paper currency in Nigeria had several significant effects on the country’s economy:

- Increased monetary independence

- Greater control over inflation and monetary policy

- Facilitation of international trade

- Boost to national identity and pride

This change allowed Nigeria to have more control over its economic destiny and paved the way for future financial developments in the country.

Has Nigeria’s currency changed since its introduction?

Yes, Nigeria’s currency has undergone several changes since paper currency was introduced in 1959. In 1973, the country replaced the Nigerian pound with the naira, which remains the official currency today. The naira has seen various denominations and designs over the years, reflecting Nigeria’s evolving economic landscape and technological advancements in currency production.

Conclusion

As you’ve learned, Nigeria’s journey to paper currency was a gradual process spanning several decades. From the introduction of British West African pounds in 1912 to the establishment of the Central Bank of Nigeria in 1958, and finally the issuance of the first Nigerian pound notes in 1959, each step paved the way for the country’s monetary independence.

Understanding this history provides valuable insight into Nigeria’s economic development and sovereignty. As you reflect on this evolution, consider how currency shapes national identity and financial systems. The story of Nigeria’s paper currency serves as a fascinating case study in the intersection of colonialism, nationalism, and economic policy in West Africa.