The ongoing war in Ukraine and the conflict between Israel and Hamas in the Middle East are big news. They are also making the global economy in 2024 very unstable. Houthi missile attacks on ships in the Red Sea add to the chaos.

These tensions are altering the way the economy operates and impacting global investments. Investors and economies must understand the impact of geopolitics on their investments.

With the world’s economy more connected than ever, geopolitical events can spread quickly. It’s crucial to stay informed about the latest news and its potential impact on investments.

Global Investments

Recent surveys show that investors worldwide are worried about geopolitical risk. This worry affects their investment choices. Geopolitical risk is now a major factor in investment risk and return, according to several surveys.

The global investment landscape is becoming increasingly complex due to rising geopolitical tensions. Investors are adjusting their strategies to address these challenges. Geopolitics impacts global investments in many ways, affecting different types of assets and investments.

Institutional investors are very concerned about the impact of geopolitical risk on their portfolios. To mitigate this risk, they are diversifying their investments. They are also exploring alternative investments that are not tied to traditional markets.

Managing and measuring geopolitical risk is becoming increasingly sophisticated. Investors are utilising new analytics and risk indices to understand better and mitigate risks. This changing landscape requires investors to stay informed about international news and trends.

As the global investment landscape continues to evolve, understanding the geopolitical implications is crucial. By staying informed about international news and trends, investors can navigate the market’s complexities more effectively. They can also spot chances for growth.

How Geopolitics Is Affecting Global Investments Today

Global investments are being affected by shifting geopolitics. The link between geopolitics and investments is getting more complex. Geopolitical risk is a significant factor in how investors make their investment decisions.

Geopolitical events can cause market swings. This affects how confident investors are and changes their strategies. Knowing the level of geopolitical risk helps understand market uncertainty.

Geopolitical risk measures give insights that traditional market measures don’t. They look at political instability, conflicts, and terrorism. These factors can greatly impact global investments.

Geopolitical Risk Measures

Geopolitical risk measures aim to quantify the risk associated with geopolitical events. They use news, expert opinions, and economic data.

| Measure | Description | Impact on Investments |

|---|---|---|

| Geopolitical Risk Index | A composite index that quantifies geopolitical risk based on news coverage and expert opinions. | High index values indicate increased risk, potentially leading to decreased investor confidence. |

| Market-Based Measures | Traditional measures of uncertainty, such as volatility indices and bond yields. | These measures can be influenced by geopolitical events, but may not fully capture the complexity of geopolitical risk. |

| Economic Indicators | Macroeconomic data, including GDP growth and inflation rates, can be influenced by geopolitical events. | Changes in economic indicators can signal shifts in geopolitical risk, which in turn influence investment decisions. |

The data illustrates why geopolitical risk is important for investments. Understanding different risk measures enables investors to make more informed choices. This way, they can handle the changing geopolitical scene.

In summary, geopolitics has a big impact on global investments. It’s key for investors to understand geopolitical risk. By utilising risk measures, investors can effectively manage risks and identify opportunities in a rapidly changing world.

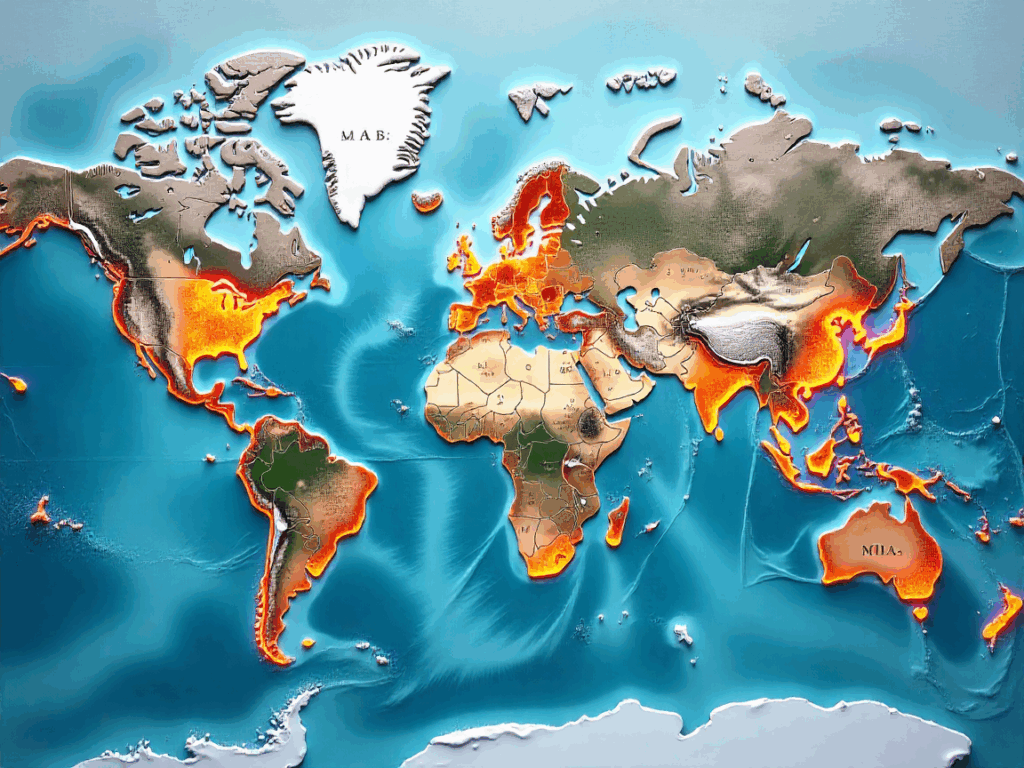

Major Geopolitical Hotspots Driving Investment Decisions

Investment landscapes are changing due to major geopolitical events and tensions. Geopolitics includes political instability, military conflicts, and terrorist threats. These can affect regions or the whole world.

Several geopolitical hotspots are currently influencing global investments. These include:

- Conflict zones that disrupt supply chains and impact resource availability.

- Regions experiencing political instability which can deter investment.

- Areas under threat from terrorism are affecting local economies.

Understanding these geopolitical hotspots is key for investors. The global economy is interconnected, and events in one region can have a ripple effect on others. For example, tensions in shipping lanes can impact global trade. Conflicts over resources can also cause price changes.

Key Geopolitical Factors Influencing Investments

Several factors are at play when considering geopolitical influences on investments:

- Political instability can lead to market volatility.

- Military conflicts can disrupt economic activity.

- Terrorist threats can impact local and regional stability.

- Geographical events, such as natural disasters, can have significant economic impacts.

Investors must navigate these complex geopolitical landscapes to make informed decisions. By understanding the various geopolitical hotspots and their associated impacts, investors can effectively manage risks and identify opportunities.

The relationship between geopolitics and global investments is complex. As the global economy evolves, staying informed about geopolitical developments is vital for investors. This will help them navigate the challenging landscape.

Emerging Markets: The Geopolitical Wild Card

Global investments are undergoing a shift, and emerging markets play a significant role in this transformation. They offer big returns but also come with big challenges. These markets are growing fast and are changing the way we invest globally.

Investing in these markets can be highly profitable due to their high growth rates. However, it’s essential to be aware of the risks. Industries such as defence, shipping, and oil and gas face increased risks due to their global reach.

Geopolitical Risks and Opportunities in Emerging Markets

The world of emerging markets is a complex one. Many factors can impact the performance of an investment. Political stability, changes in rules, and tensions between countries are all important.

| Industry | Geopolitical Risk Level | Investment Opportunity |

|---|---|---|

| Defense | High | Significant contracts in emerging markets |

| Shipping | Medium | Growing trade volumes in emerging regions |

| Oil and Gas | High | Large reserves in geopolitically sensitive areas |

It’s key for investors to understand these factors. This way, they can capitalise on the growth in emerging markets while mitigating risks. By examining the geopolitical landscape and its impact on various industries, investors can make informed decisions.

Smart Investment Strategies Amid Geopolitical Uncertainties

In today’s world, investors face many challenges. They require effective strategies to address these issues. Understanding how geopolitical risks affect investments is key. Tools like the Geopolitical Risk Index (GPR) help investors make better choices.

Managing geopolitical risks requires the use of both quantitative analysis and deeper insights. Numbers give us data to assess risks. However, a deeper analysis helps us understand the actual impact of these risks.

Quantitative Tools for Measuring Political Risk

Quantitative tools, like the GPR, measure geopolitical risk. They examine various factors to assess the risk associated with an area or investment. This helps investors know where to be careful.

Qualitative Analysis Techniques

Qualitative analysis examines the political, social, and economic contexts of a place. It evaluates factors such as government stability and economic health. This helps us identify potential risks that may be on the horizon.

| Tool/Technique | Description | Application |

|---|---|---|

| Geopolitical Risk Index (GPR) | Quantifies geopolitical risk based on news coverage and other factors. | Assessing regional risk levels. |

| Qualitative Risk Assessment | Involves evaluating political, social, and economic contexts. | Understanding possible risks and chances. |

| Scenario Planning | Creates hypothetical scenarios to guess future geopolitical events. | Planning strategies and reducing risks. |

By combining these methods, investors gain a comprehensive understanding of geopolitical risks and opportunities. This helps them make smart investment choices. It also helps them build strong portfolios.

Investment Opportunities in a Changing World Order

The global economy is undergoing significant changes due to global politics. Even with the ups and downs of global events, big economies are holding strong. They are dealing with one of the toughest times for money policies in years.

As the world economy continues to evolve, investors need to be aware of new opportunities. It’s essential to understand how global politics impacts investments. This connection enables investors to identify emerging trends and make informed decisions.

In this new world, there are chances to invest in different areas. By staying informed about global politics and adapting, investors can achieve success. The key is to remain vigilant and adapt to the dynamic interplay between politics and investments.

FAQ

How is geopolitics currently affecting global investments?

Geopolitics is greatly affecting global investments. Conflicts like the war in Ukraine and the Israel-Hamas conflict are causing uncertainty. They also influence how investors make their decisions.

What are the major concerns of institutional investors regarding geopolitics?

Institutional investors are concerned about how geopolitical events might impact their investments. They fear losses due to wars, terrorism, and political instability.

How is geopolitical risk being measured and managed?

To measure and manage geopolitical risk, a mix of methods is used. This includes geopolitical risk indices and scenario planning. These tools help predict possible outcomes.

What are the major geopolitical hotspots driving investment decisions?

Areas with conflict, political instability, or terrorism are key. Places like Ukraine, the Middle East, and parts of Africa are major concerns.