By the time the sun came up on the first trading week of January 2025, people close to First Bank of Nigeria already sensed something different in the air. The bank that had lived through colonial rule, independence, coups, market crashes, recapitalisation waves and every form of financial drama Nigeria had ever produced was moving into a new phase. No one knew what shape it would take. All they knew was that the ground under the institution was shifting.

The shift did not reveal its full shape until the events that came later. A massive off market movement of 10.43 billion shares in July 2025. A restructuring plan that surfaced during the annual meeting earlier in the year. The slow exit of some of the old power blocs. The gradual rise of a new dominant shareholder. And the sudden appearance of a quiet trust company that set off another round of speculation.

When people talk about a First Bank overhaul in 2025, they are not talking about one single moment. They are talking about a chain of events that drew a line straight through the year and rearranged influence in one of the most powerful financial institutions in the country.

This is a look at who gained, who lost, and the investor who read the signs long before the market caught up.

The big move everybody was talking about

The moment that changed the conversation happened in July 2025. It was a block trade so large that it froze the market’s breath for a moment. On that day, 10.43 billion units of FBN Holdings shares exchanged hands away from the open market. The value of that single movement was about three hundred and twenty three point four billion naira. The kind of number that does not just slide past analysts. It forces everybody to start asking questions.

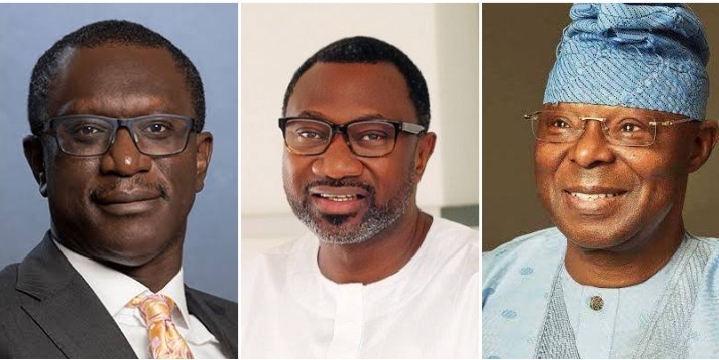

Before the dust settled, reports from inside the capital market confirmed what many suspected. Two long time power figures who had shaped First Bank’s direction for years were stepping aside. Oba Otudeko, whose presence always represented deep corporate roots, and Tunde Hassan Odukale, whose influence had been anchored in the insurance and pension space, allowed their holdings to be absorbed into the massive transaction. That exit alone would have been enough to signal a new chapter. But this was just the first door opening.

Who really bought all that stock

For weeks after the July trade, the market gossip leaned heavily on one name. People believed the buyer was the same person whose aggressive positioning had been visible since late 2023, the same investor whose moves kept sending signals long before the rest of the market picked their meaning.

But the official confirmation that came later surprised many. FBN Holdings announced that the buyer was RC Investment Management Limited, a trust company. That announcement came around November 2025 when the bank released more details. The company stated clearly that the block of 10.433 billion shares belonged to that trust. They added that it was not Femi Otedola, and it was not the federal government. The trust was the beneficial owner, which meant a new quiet player had stepped into the mix.

Yet this did not wipe away the earlier developments. Even before that confirmation, the market had been watching Otedola’s steady climb.

That one person who saw the opening early

Femi Otedola did not appear in the First Bank story out of nowhere. His journey started years back, but 2025 was the year everything aligned in his favour. By the time the first quarter reports were coming out, his stake had crossed the ten percent line earlier in the year. It kept rising as the year moved. Not at the speed of a hostile takeover. Not with the noise of a spectacle. Just steady positioning, accumulation and timing.

People who follow his style know that he does not jump into an institution like First Bank unless he has read the environment and the pressure points. He watched the recapitalisation demands coming from the Central Bank. The announcement of new thresholds put every bank under pressure. First Bank management acknowledged in late 2025 that they were on track to meet the recapitalisation requirement, but that journey required restructuring and fundraising. This was the environment Otedola understood well.

By the time the annual general meeting held earlier in 2025, the bank openly confirmed its push for new capital. They laid out plans for strengthening governance, realigning ownership and adjusting the internal system. Those plans told the whole market that a shift was unavoidable. Otedola had positioned himself long before the foundations started moving. If the question is whether he saw it coming, the answer sits clearly inside those early purchases.

Street talk breakdown of what really changed

If someone stopped people in Marina or Broad Street and asked what changed in First Bank in 2025, the answer would not be some academic breakdown. They would say something simple. Something like the old guards stepped out, new money moved in, and the whole place started moving like it wants new life.

And that is not far from the truth. The recapitalisation wave that hit all Nigerian banks meant that institutions with heavy legacy structures needed to strengthen their capital base. First Bank had been through leadership tension before, including the board issues that exploded years back. So when the 2025 requirements arrived, the institution had to respond with more seriousness.

The share transactions, the exit of long heads, the rise of a visible shareholder and the appearance of a trust all shaped the new power structure. Nothing was neat. Nothing was linear. But everything pointed toward real change.

Who walked away with more power in 2025

In any shake up, people gained ground while others lost grip. Femi Otedola increased his stake earlier in the year, crossing ten percent and pushing even higher. His position became undeniable. Even with the RC Investment twist, he remained a heavyweight in the new arrangement.

The push to raise new capital, the open admission at the AGM, and the confirmation that the bank was on track to meet the CBN target gave the bank a stronger long term footing. Shareholders who entered early in the year benefited from the sudden power play that raised demand.

The trust company RC Investment ended up holding the single largest block of shares by the end of 2025, placing them at the center of future decisions. Managers aligned with the recapitalisation agenda and the internal team that supported the new plan gained more authority as the bank openly declared its restructuring intentions.

Who stepped back or lost ground

Oba Otudeko’s exit from such a significant block in July 2025 ended an era of influence while Tunde Hassan Odukale’s presence faded after the same block sale. Shareholders who resisted Otedola earlier in the year tried to push for an extraordinary general meeting in January 2025 but the year did not bend in their direction. Old guard networks inside the bank that relied on the previous ownership alignment saw their influence diluted. Legacy governance arrangements were forced to change as new capital requirements and the need for fresh investment made older structures unsustainable.

The messy middle where everything is still forming

One thing people forget is that the overhaul did not end in 2025. The recapitalisation window extends beyond a single calendar year. The ownership structure is now more complicated because of the role of the trust. Otedola has influence but not in a clean straight line. The old networks are gone but the new order is still settling into place. Even the question of who really controls the bank depends on how much clarity emerges about RC Investment’s long term plans.

When people talk about winners and losers, it is correct but only partially complete. The real outcome will be clearer when the recapitalisation is fully completed and the board’s structure stabilises.

Why the bank had no choice but to move fast

The CBN recapitalisation requirement was not a small matter. Banks needed to raise fresh funds or risk losing their position. First Bank, with its long history and broad footprint, could not afford any misstep. By the time management stated in late 2025 that they were on track to meet the requirements, it was clear the institution had taken the restructuring seriously. The 2025 AGM already showed the direction. The market understood that the bank was trying to rebuild its foundation while the ownership chessboard was being rearranged.

It was this pressure that made the big 10.43 billion share movement even more significant. It told the market that someone was preparing for the long road ahead.

What 2026 might reveal

The story is still forming. The recapitalisation deadline will force more clarity. The trust holding the 10.433 billion shares will eventually show its strategy. Otedola’s position will either grow or reorganise depending on how the bank manages its fundraising journey. The board may shift again. The governance structure may evolve. And the market will revalue First Bank based on the new foundation it builds after the storm of 2025.

Final Word: A year nobody will forget

If someone writes the official history of First Bank in the future, 2025 will sit as one of those years where everything changed direction. A year where ten point four three billion shares moved in silence. A year where deep old alliances stepped back. A year where a trust stepped into the center. A year where one investor proved he had read the signs earlier than others. A year where recapitalisation forced an institution to choose renewal.

The overhaul is real. The winners and losers are visible. And the story of who really controls the bank is still unfolding. The only certain thing is that the First Bank that entered January 2025 is not the same First Bank stepping into the years ahead.

Discussion about this post