In early 2025, something unusual began stirring on the Nigerian Stock Exchange. Ordinary investors, armed only with smartphones and a little patience, noticed their portfolios swelling in ways they never imagined.

Stocks once dismissed as “too small to matter” were suddenly dominating headlines. Beta Glass, Honeywell Flour Mills, Vitafoam, Smart Products, and The Initiates Plc (TIP) were surging at rates that baffled even seasoned traders.

It was a story of quiet transformation, of small companies turning into market stars almost overnight. But why were these mid-cap stocks performing so dramatically? And what did it mean for the everyday Nigerian investor?

This article takes you inside the rise of Nigeria’s mid-cap market in 2025, explaining the story in plain, non-technical language, while revealing the human, economic, and strategic factors driving this phenomenon.

Understanding Mid-Cap Stocks

Mid-cap companies occupy a space between micro-caps and large, established corporations. With market capitalizations typically ranging from ₦50 billion to ₦500 billion, they are often overlooked because they are neither massive nor tiny. Yet in 2025, their size became a competitive advantage. They were big enough to withstand minor market shocks but nimble enough to innovate and respond to consumer and investor demands quickly.

In Nigeria, mid-caps are particularly attractive because they frequently operate in sectors with strong growth potential. Manufacturing, consumer goods, and essential services are areas where mid-sized firms can move faster than larger competitors while maintaining operational stability.

Unlike speculative micro-caps, they generate tangible revenue. Unlike massive corporations, they can pivot quickly when market conditions shift. For investors, this combination of stability and agility created fertile ground for returns that were both significant and surprisingly accessible.

The Stars of the Mid-Cap Market

Beta Glass: Manufacturing Brilliance

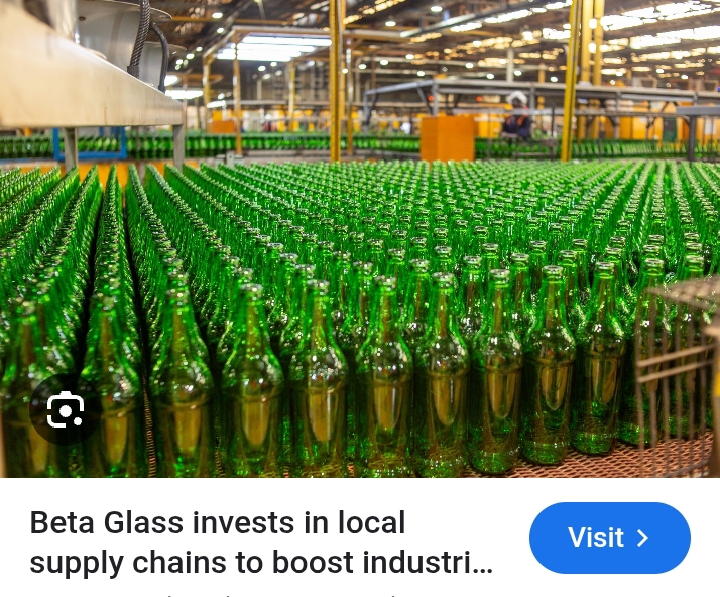

Beta Glass Plc had long been a fixture in Nigeria’s industrial landscape, producing glass containers for beverages, pharmaceuticals, and food. For years, it had been a stable but unremarkable performer. In 2025, everything changed. The company expanded production capacity, modernized its factories, and secured strategic foreign investments that allowed it to scale efficiently without compromising margins.

Profit after tax for the first half of 2025 surged by 334 percent, reaching ₦18.7 billion. Investors who had purchased shares at the beginning of the year witnessed a staggering increase of over 600 percent in the stock’s value by September. For many retail investors, the experience was transformative.

A Lagos-based investor recounted checking his phone hourly as the price climbed. “I couldn’t believe it,” he said. “Every time I refreshed, the number went higher. It was like watching my savings grow in real time.” The surge wasn’t merely about numbers. Beta Glass became a symbol of disciplined management meeting market opportunity. Employees, too, felt the impact. Workers on the production floor recognized that efficiency, strategy, and careful planning could translate into tangible financial outcomes not just for shareholders but for the community as a whole.

Honeywell Flour Mills: The Comeback Story

Honeywell Flour Mills tells a different narrative—one of recovery and resilience. For years, the company had struggled with operational inefficiencies and fluctuating profitability. But in 2025, Honeywell executed a focused restructuring, streamlining production lines, optimizing logistics, and refocusing on its core flour business.

Earnings per share, which had been negative in 2024, climbed to a profit of ₦1.84 by mid-2025. Investors who held through the downturn were rewarded handsomely, with the stock posting over a 250 percent gain year-to-date. Beyond numbers, Honeywell’s rise illustrated the importance of strategic adaptation in a competitive market.

For retail investors, the story was instructive. Patience, careful analysis of company fundamentals, and an understanding of sector dynamics could turn previous losses into significant gains. Many everyday Nigerians used profits from Honeywell shares to cover essential expenses, such as school fees and medical bills, demonstrating the tangible impact of mid-cap growth on daily life.

Vitafoam: Riding Consumer Demand

Vitafoam’s ascent was fueled by demographic and lifestyle trends. As Nigeria’s middle class expanded, demand for home comfort products—mattresses, cushions, and furniture—grew rapidly. Vitafoam anticipated this shift, investing in product quality, innovation, and an efficient distribution network. The company’s stock surged by over 220 percent in 2025, reflecting not just financial performance but a broader societal trend: evolving aspirations and changing consumer behavior.

Middle-class families, urban professionals, and even corporate buyers increasingly sought quality products that balanced affordability with reliability. Vitafoam’s rise demonstrated how understanding and responding to consumer demand could produce outsized results, particularly for mid-cap companies positioned to move quickly and decisively.

Smart Products Nigeria: Brand Trust and Consistency

Smart Products Nigeria, a household name for personal care and cleaning products, showcased the power of brand trust and operational consistency. The company’s stock increased by 260 percent year-to-date, driven by reliable distribution, strong sales, and a low price-to-earnings ratio that hinted at continued growth potential.

For many investors, Smart Products was a lesson in the enduring value of recognizable brands and repeatable revenue streams. Unlike speculative plays, companies like Smart Products offered tangible goods with established demand, reducing the uncertainty that often accompanies smaller, newer firms.

The Initiates Plc: Profitability with Purpose

The Initiates Plc (TIP) carved out a unique niche in urban waste management. Combining technology with logistics, TIP addressed the growing sanitation challenges in Nigerian cities while building a recurring revenue model. The stock rose by over 230 percent in 2025, demonstrating that service-oriented mid-cap companies could achieve both financial success and social impact.

For TIP, investor confidence was intertwined with societal relevance. Urban populations, increasingly conscious of hygiene and sustainability, responded to the company’s effectiveness. The stock’s performance reflected a market realization that profitability and social responsibility could go hand in hand.

The 2025 Surge: Economic and Social Factors

Several forces converged to drive the mid-cap surge in 2025. Domestic economic indicators had stabilized, creating an environment conducive to business growth. Urbanization and rising incomes bolstered demand for consumer goods and home essentials. Foreign and local investment signaled confidence in corporate strategy, while retail investors, empowered by smartphones and social media communities, injected liquidity and energy into the market.

Unlike previous mid-cap booms, which often fizzled due to weak governance or external shocks, the 2025 surge appeared more durable. Companies had learned from past mistakes, focusing on operational efficiency, governance, and strategic growth rather than short-term speculation.

Human Stories Behind the Numbers

Investing is about people as much as it is about numbers. Stories from everyday Nigerians highlight the transformative impact of the mid-cap boom. A teacher in Lagos used her Honeywell profits to fund her child’s schooling. A Beta Glass factory worker reflected on how disciplined effort and operational efficiency translated into market success, illustrating the human side of corporate performance. Social media forums became arenas of collective learning, where investors shared insights, warned against risks, and celebrated milestones.

The mid-cap phenomenon, in this sense, was not just a financial event. It was a social movement, showing that ordinary Nigerians could engage with markets meaningfully, learn from data, and experience tangible benefits.

Navigating Risks

Despite its allure, the mid-cap market is not without hazards. Volatility can be sudden, with stock prices reacting sharply to policy changes, currency fluctuations, or supply chain disruptions. Liquidity may be limited for certain stocks, making it challenging to execute large trades without affecting prices. Operational missteps, even small ones, can ripple through profits and investor sentiment.

For non-experts, these risks underscore the importance of cautious, informed investing. Patience, research, and diversification are essential tools for navigating a market that offers both opportunity and uncertainty.

Sectoral Insights

The mid-cap boom illustrates how specific sectors can drive market growth. Manufacturing companies, like Beta Glass and Vitafoam, thrive on industrial expansion and innovation. Consumer goods firms, such as Honeywell and Smart Products, capitalize on brand strength and distribution efficiency. Service-oriented companies, exemplified by TIP, demonstrate that profitability and societal relevance can coexist, offering investors a multi-dimensional view of economic opportunity.

Looking Back and Forward

Historical comparisons show that Nigeria has experienced mid-cap surges before, but they often lacked sustainability. In contrast, the 2025 rise is grounded in strategic execution, market responsiveness, and solid economic fundamentals.

Looking ahead, mid-cap companies are positioned to continue influencing wealth creation, investor behavior, and broader economic trends. Retail investors who study fundamentals, track sector performance, and approach the market thoughtfully are likely to remain key beneficiaries of this ongoing transformation.

Final Thoughts: The Mid-Cap Revolution

The story of Nigeria’s mid-cap stocks in 2025 is a story of transformation. Beta Glass, Honeywell Flour Mills, Vitafoam, Smart Products Nigeria, and TIP exemplify how smaller companies can deliver outsized returns when strategy, timing, and market conditions align.

For everyday investors, the lesson is clear. With patience, research, and engagement, ordinary Nigerians can harness the potential of mid-caps to grow wealth, support economic development, and participate in a market that is both dynamic and accessible.

The mid-cap revolution demonstrates that in Nigeria, the most profound impact is not always made by the largest companies. Sometimes, the most remarkable growth comes from the companies that once went unnoticed, quietly building foundations for financial transformation.

Discussion about this post