- Peter Obi criticizes MPC’s decision to raise MPR and CRR, predicting worsened economic challenges for Nigerians; advocates for practical solutions

- Obi warns against reliance on classical economic theories, highlighting potential job losses and limited effectiveness of tightening liquidity measures

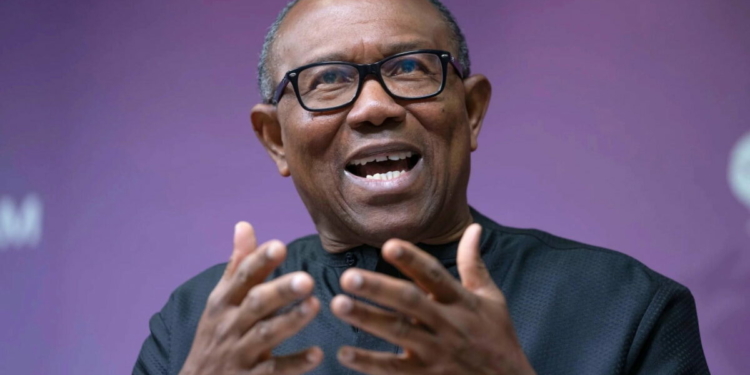

Peter Obi, the presidential candidate of the Labour Party (LP) in the 2023 general elections, has voiced his disapproval of the recent decision by the Monetary Policy Committee (MPC) to raise the Monetary Policy Rate (MPR) to 22.5% and the Cash Reserve Ratio (CRR) to 45%. He believes this move will exacerbate the economic challenges faced by many Nigerians.

In a series of posts on his social media handle on Thursday, Obi argued that the hike in MPR, also referred to as interest rate, would be counterproductive and fail to achieve its intended purpose of managing money supply.

He cautioned against relying solely on classical economic theories, emphasizing the need for practical, innovative solutions to address the country’s economic woes. Obi expressed concerns that the increased interest rate would lead to job losses in key sectors, particularly manufacturing and others reliant on bank loans and credit facilities for funding.

Obi highlighted that tightening liquidity in the financial system does not translate to improved productivity, particularly in vital sectors like food production, which significantly contributes to Nigeria’s inflation. He noted that a considerable portion of the country’s money supply remains outside the banking system, limiting the effectiveness of measures to control inflation.

Overall, Obi stressed the importance of adopting strategies that promote sustainable economic growth and alleviate the financial burden on Nigerian households.

Discussion about this post