- Naira rebounds to N1280/$ in the parallel market, marking an 8.57% gain compared to Friday’s N1400/$ rate

- Currency traders report selling rates between N1280 and N1300 per dollar, signalling increased stability in the forex market

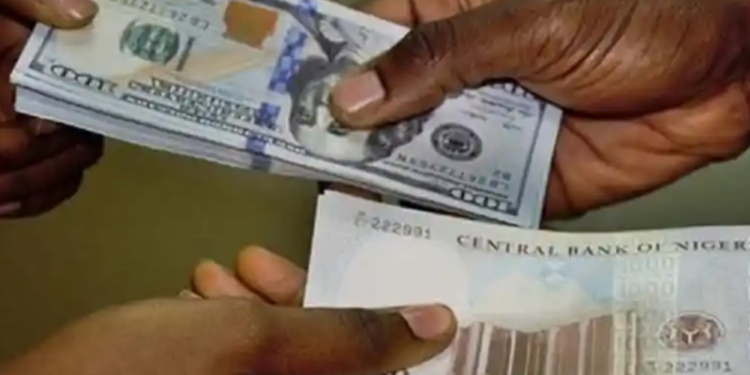

Yesterday, the Naira rebounded against the US dollar in the parallel market, appreciating to N1280/$, according to information from currency traders obtained by Nairametrics.

This signifies a gain of N120, representing an 8.57% increase compared to the N1400/$ rate it traded on Friday.

Currency traders reported selling rates ranging between N1280 and N1300 per dollar.

Earlier in the week, the Naira had experienced a significant depreciation, losing a third of its value barely two weeks after strengthening to below N1000 against the dollar. It then dropped to N1400 against the dollar in the black market due to reports of fresh demand pressure.

Questions arose regarding the impact of the Central Bank of Nigeria’s (CBN) sale of $15.83 million to 1583 Bureau De Change (BDC) operators as the Naira depreciated.

The recent depreciation of the Naira has been attributed to market forces, with demand outpacing supply. Despite the CBN’s efforts to stabilize the foreign exchange market by increasing forex accessibility for qualified end users, the Naira’s value continued to decline.

Data from FMDQ indicated that the Naira’s downward trend against the US dollar persisted at the official foreign exchange window. On Friday, it closed at N1339.23/$1, representing a 2.24% depreciation from the previous day’s rate of N1309.88/$1.

Recent initiatives by the CBN have alleviated forex scarcity, facilitating Naira’s recovery from an early March rate of N1617 per dollar to N1072 per dollar on April 17.

Discussion about this post